Kathmandu tackles apparel industry’s problems in SLL

Kathmandu Holdings’ well-defined sustainability strategy enabled it easily to align its financial arrangements with the metrics of a sustainability-linked loan. The issuer says addressing the apparel sector’s industry-wide problems in its loan metrics was key to getting the transaction over the line.

Kathmandu Holdings completed a refinancing of its syndicated debt facilities on 26 May, consisting of a A$100 million (US$76 million) sustainability-linked loan (SLL) and a A$200 million vanilla tranche – both at three-year tenor. ANZ and National Australia Bank (NAB) were joint sustainability coordinators.

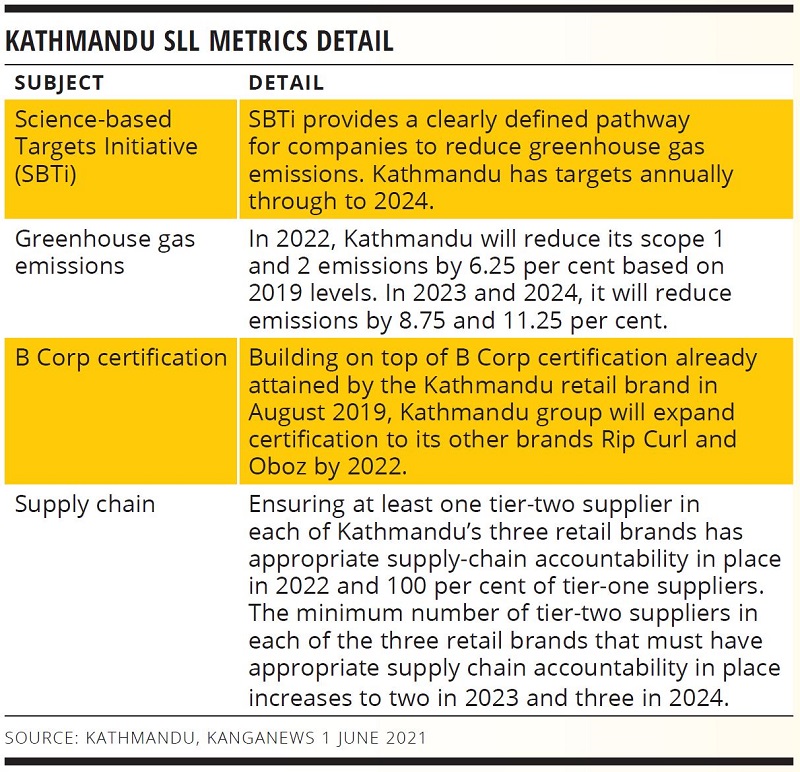

The sustainability-linked loan (SLL) has four key metrics. These target the group’s greenhouse-gas emissions, achieving B Corp certification across the group, and improving the transparency surrounding, and wellbeing and the labour conditions of, workers in its supply chain (see table).

Chris Kinraid, chief financial officer at Kathmandu in Christchurch, tells KangaNews the incentive for Kathmandu to undertake the SLL was to drive alignment between its sustainability strategy and financial arrangements.

“We are setting ESG [environmental, social and governance] targets across our business. My role as chief financial officer is to look at what part finance can play in driving sustainability goals within our business and to hold ourselves internally accountable,” he says.

Most SLLs in the Australian and New Zealand markets have reducing greenhouse-gas emissions as a key metric. Kathmandu includes similar goals, but its targets on supply-chain management could be even more salient given the industry-wide problems of unsafe work environments, modern slavery and environmentally unfriendly materials.

The issuer holds accreditation from the Fair Labor Association, which verifies that Kathmandu’s social-compliance programme for its supply chain exceeds global standards. Kinraid says Kathmandu already audits its tier-one suppliers so it made sense to align its financing with targets in this space.

Much the same can be said for Kathmandu’s approach to B Corp certification. B Corp assesses the overall positive impact of a company through its relationship with workers, customers, community and the environment. Companies are scored out of 160 points, with 80 points required to achieve certification, and the results disclosed on the web.

Kathmandu’s retail brand attained certification in 2019 and currently holds a score of 82.2. As well as expanding certification to Rip Curl and Oboz, Kinraid explains that the group aims to become a leading global B Corp by 2025 as part of its five-year sustainability strategy.

“There is a lot of greenwashing out there, so it is vital that a business’s change is meaningful and measurable. Going through verifiers like B Corp provides confidence to external stakeholders – and B Corp is widely regarded as a certification that demonstrates this quite strongly.”

While the targets Kathmandu has set as part of its SLL were already part of its five-year strategy, Kinraid tells KangaNews that ensuring they were challenging enough was a key part of the discussions with ANZ and NAB.