Asian Development Bank

| SECTOR | Supranational |

| RATINGS | AAA/Aaa/AAA |

| RATING OUTLOOK | All stable |

| PAID-IN CAPITAL (31 Dec 2020) | US$7.7BN |

| CALLABLE CAPITAL (31 Dec 2020) | US$145.6BN |

| FUNDING VOLUME 2020/2021 | US$36BN/US$35BN |

| RISK WEIGHT, LCR LEVEL | 0%, HQLA Level 1 |

| REPO ELIGIBILITY | BoE, ECB, RBA, RBNZ, US Fed |

About Asian Development Bank

Asian Development Bank (ADB) is committed to achieving a prosperous, inclusive, resilient and sustainable Asia and Pacific while sustaining its efforts to eradicate extreme poverty. Established in 1966, ADB is owned by 68 members – 49 from the region. Its main instruments for helping its developing-member countries are policy dialogue, loans, equity investments, guarantees, grants and technical assistance.

SUSTAINABILITY OBJECTIVES OF GSS BOND PROGRAMME

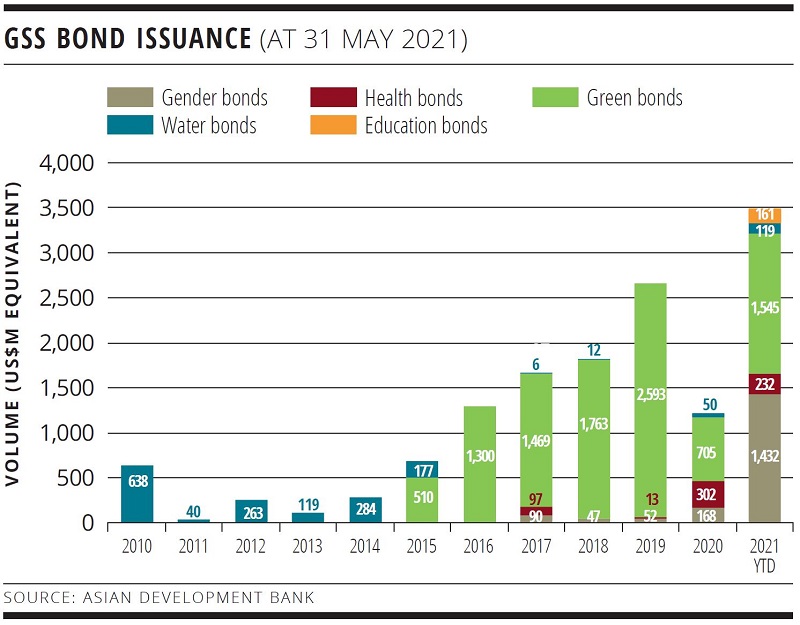

The ADB green bond programme enables ADB to support its DMCs seeking to mitigate GHG emissions and adapt to the consequences of climate change, while delivering environmentally sustainable growth to help reduce poverty and improve the quality of life of their people. The programme aims to channel more investor funds to ADB projects that promote low-carbon and climate-resilient economic growth and development in developing Asia.

| GSS BOND PROGRAMME | Green bond programme |

|

REFERENCE TAXONOMY FOR THE USE OF PROCEEDS |

Green Bond Principles project categories |

| FRAMEWORKS WITH WHICH THE GSS BOND PROGRAMME IS ALIGNED | Green Bond Principles |

| EXTERNAL REVIEW PROVIDERS | CICERO |

PUBLIC ISSUER ESG RATINGS/SCORES

| INSTITUTION | RATING/SCORE |

| ISS-oekom Sustainalytics Vigeo Eiris |

B (2018) 78 (2018) 69 (2018) |

Sustainable funding strategy

ADB continues to scale up its support to help its developing-member countries tackle climate change, building climate and disaster resilience and enhance environmental sustainability.

ADB’s Strategy 2030 set two climate targets. The first is ensuring that by 2030, 75% of ADB’s operations will support climate mitigation and adaptation. The second is that climate finance from ADB’s own resources will reach US$80 billion cumulatively between 2019 and 2030. These targets are guiding ADB operations, within the context of which green financing facilities are being established. ADB considers the environmental objectives to be sufficient and efficient incentives to increase the share of green financing.

FOR FURTHER INFORMATION PLEASE CONTACT:

This email address is being protected from spambots. You need JavaScript enabled to view it.

www.adb.org/site/investors/main

SSA Yearbook 2021

The annual guide to the world's most significant supranational, sovereign and agency sector issuers.