EUROFIMA

| SECTOR | Supranational |

| RATINGS | AA/Aa2 |

| RATING OUTLOOK | Both stable |

| PAID-IN CAPITAL (31 Dec 2020) | €479M |

| CALLABLE CAPITAL (31 Dec 2020) | €1.9BN |

| FUNDING VOLUME 2020/2021 | €3.2BN/€500M |

| RISK WEIGHT | 20% |

| REPO ELIGIBILITY | SNB |

About EUROFIMA

European Company for the Financing of Railroad Rolling Stock (EUROFIMA) is a supranational organisation located in Basel. It was established in 1956 based on an international treaty signed by 25 European sovereign states. EUROFIMA fulfils a public mission to support the development of rail transportation in Europe.

Sustainable funding strategy

Supporting the growth and development of passenger-rail transport is key to addressing the problem of CO2 emissions attributable to the transportation sector. As countries across Europe work to meet the sustainability targets outlined by Europe 2020 and by the COP21 agreement, EUROFIMA is determined to serve as partner to its contracting states in fulfilling their objectives.

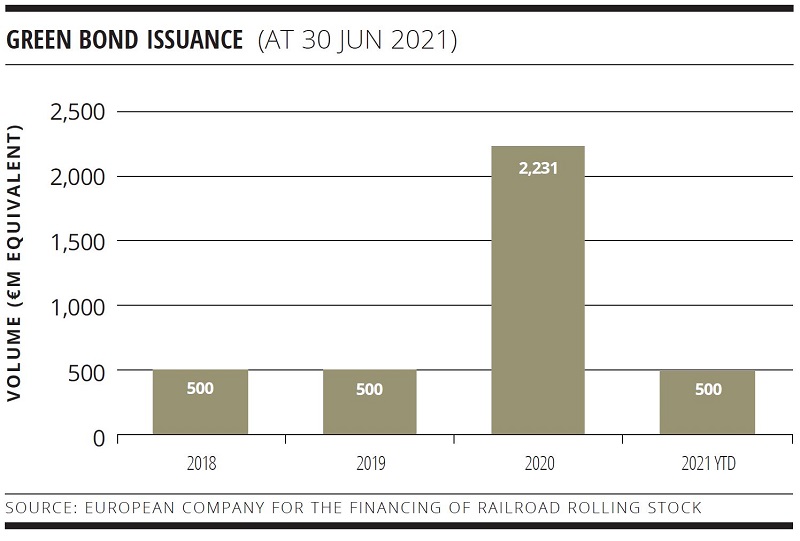

EUROFIMA published a Green Bond Framework in 2018 under the Green Bond Principles, with use of proceeds focusing solely on financing electric rolling stock for passenger-rail transportation.

EUROFIMA’s mission to provide attractive funding for passenger-railway investments in the public-transportation sector underlines two of the UN Sustainable Development Goals in the main: goal 9 – Innovation and Infrastructure and goal 11 – Sustainable Cities and Communities.

FOR FURTHER INFORMATION PLEASE CONTACT:

Harry Mueller

Chief Operating Officer

+41 61 287 3318

This email address is being protected from spambots. You need JavaScript enabled to view it.

www.eurofima.org

SUSTAINABILITY OBJECTIVES OF GSS BOND PROGRAMME

By securing funding for electric passenger transport through its lending model, EUROFIMA is not only contributing to creating a greener world, but also helping its members constantly to modernise and improve the travel experience they offer to millions of customers.

| GSS BOND PROGRAMME NAME | Green bonds for electric passenger rolling stock |

|

REFERENCE TAXONOMY FOR THE USE OF PROCEEDS |

Issuer’s own definitions – clean transportation |

| FRAMEWORKS WITH WHICH THE GSS BOND PROGRAMMES ARE ALIGNED | Green Bond Principles |

| EXTERNAL REVIEW PROVIDERS | Sustainalytics |

PUBLIC ISSUER ESG RATINGS/SCORES

| INSTITUTION | RATING/SCORE |

| MSCI Sustainalytics |

BBB, controversies 10/10 5.2 negligible risk |

SSA Yearbook 2021

The annual guide to the world's most significant supranational, sovereign and agency sector issuers.