European Investment Bank

| SECTOR | Supranational |

| RATINGS | AAA/Aaa/AAA |

| RATING OUTLOOK | All stable |

| PAID-IN CAPITAL (1 Jun 2021) | €22.2BN |

| CALLABLE CAPITAL (1 Jun 2021) | €226.6BN |

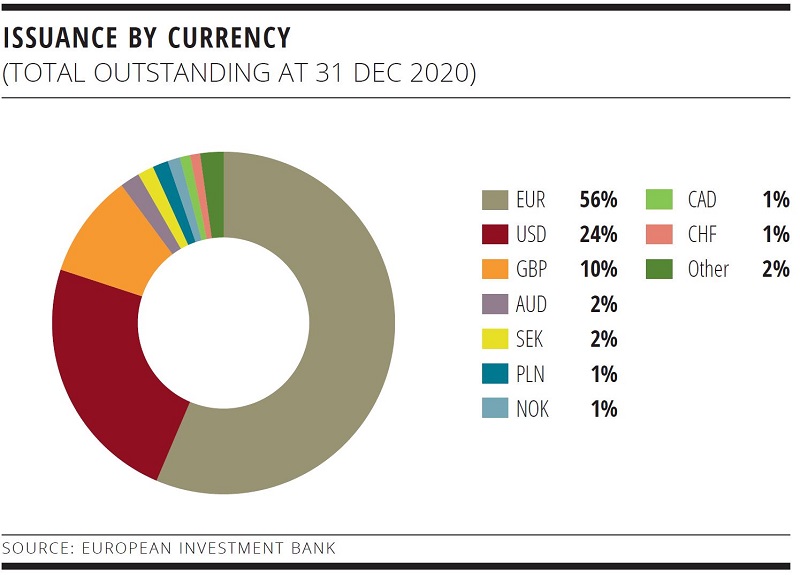

| FUNDING VOLUME 2020/2021 | €70BN/€60BN |

| RISK WEIGHT, LCR LEVEL, SOLVENCY II | 0%, Level 1, 0% |

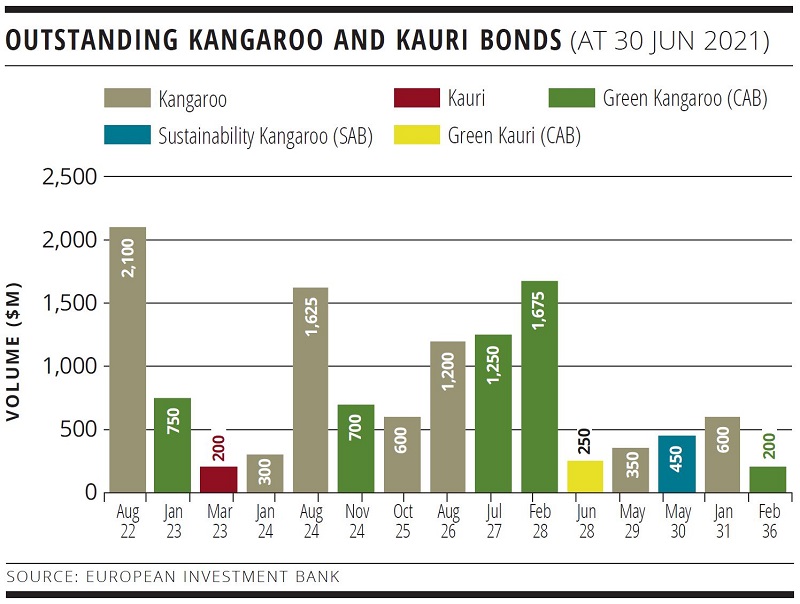

| REPO ELIGIBILITY | ECB, BoE, US Fed, ECB QE, CB Sweden, CB Hungary, Czech National Bank, National Bank of Poland, RBA, RBNZ |

About European Investment Bank

European Investment Bank (EIB) is the European Union (EU)’s bank, created by the Treaty of Rome in 1958 and wholly owned by the 27 EU member states. EIB is the largest multilateral financial institution in the world and one of the largest providers of climate finance.

The bank is the lending arm of the EU: its task is to provide finance and expertise for sound and sustainable investment projects furthering EU policy objectives. In particular, EIB supports projects that make a significant contribution to growth and employment. Its focus in on the following priority areas: climate and environment, innovation and skills, infrastructure, access to finance for smaller businesses, cohesion, and development.

While most of its operations are in Europe, EIB is active in 140 countries. It finances its operations by raising substantial volume in the international capital markets and passing its funding advantage onto clients on the lending side.

Sustainable funding strategy

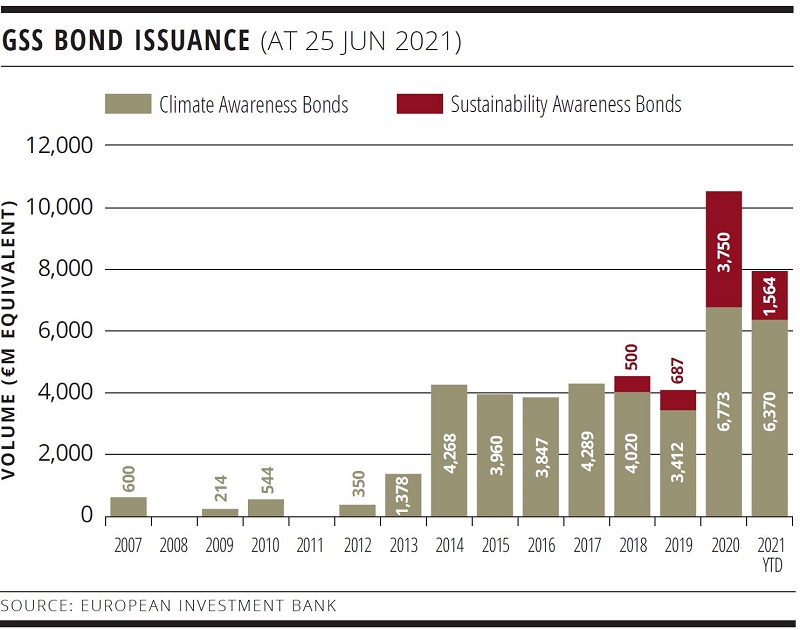

EIB’s sustainability-funding team pursues the issuance of Climate Awareness Bonds (CABs) and Sustainability Awareness Bonds (SABs). The first CAB was issued in 2007 and inaugurated the green bond market. CABs are allocated to financing activities contributing substantially to climate change mitigation. The first SAB was issued in 2018. SABs complement CABs with allocations to further areas of environmental and social sustainability.

EIB’s Climate Bank Roadmap outlines the bank’s strategic plan for 2021-2025 and commits EIB to the following areas:

• Increasing the share of green finance to exceed 50% of new annual loans by 2025.

• Aligning its tracking methodology for green finance with the EU Taxonomy Regulation.

• Reflecting such alignment to capital markets via extension of CAB and SAB eligibilities.

• Gradually aligning CABs and SABs with the proposed EU Green Bond Standard.

EIB is the first issuer to have tuned the documentation of its CABs and SABs to the evolving EU legislation on sustainable finance, including the EU Taxonomy Regulation, which has been in force since July 2020. This approach establishes a direct link between EU sustainability policy objectives and EIB’s sustainability lending and funding activities. This will permit the bank gradually to extend CAB and SAB loan eligibilities as the EU Sustainability Taxonomy (EST) is rolled out on the lending side.

Regarding CABs, a first extension of eligibilities based on the EST proposals and approach took place in June 2020 – to low-carbon transport and innovative low-carbon technologies. SAB eligibilities were extended in April 2020 to other financing areas directly related to the fight against COVID-19 and, in 2021, to sustainable forest management – contributing to “protection and restoration of biodiversity and ecosystems” (EU Taxonomy Regulation objective number 6).

SUSTAINABILITY OBJECTIVES OF GSS BOND PROGRAMMES

CAB: Climate-change mitigation

SAB: Environmental objectives beyond climate-change mitigation, social objectives

| GSS BOND PROGRAMME NAMES | Climate Awareness Bond (CAB), Sustainability Awareness Bond (SAB) |

|

REFERENCE TAXONOMY FOR THE USE OF PROCEEDS |

Upcoming EU Sustainability Taxonomy |

| FRAMEWORKS WITH WHICH THE GSS BOND PROGRAMMES ARE ALIGNED |

CAB: Green Bond Principles |

| EXTERNAL REVIEW PROVIDER |

For CABs and SABs: KPMG Luxembourg – Independent Reasonable Assurance as per International Standard on Assurance Engagements 3000 |

PUBLIC ISSUER ESG RATINGS/SCORES

| INSTITUTION | RATING/SCORE (all unsolicited) |

| DZ Bank | 86/100 seal of quality for sustainability in 2018 (1st among SSAs) |

| ISS-oekom | B-, Prime (best among MDBs) in 2020 |

| imug | Positive BBB 74.38% in 2019 (1st of 19 banks) |

| MSCI | AAA – 8.8/10 |

| Sustainalytics | ESG risk rating 4.9%, (3rd in whole universe in 2021) |

| Vigeo Eiris | 68/100 (in 2020) |

FOR FURTHER INFORMATION PLEASE CONTACT:

Nathalie de Weert

Head of Funding for Public Markets

+352 4379 86210

This email address is being protected from spambots. You need JavaScript enabled to view it.

Aldo Romani

Head of Sustainability Funding

+352 4379 86230

This email address is being protected from spambots. You need JavaScript enabled to view it.

This email address is being protected from spambots. You need JavaScript enabled to view it.

www.eib.org/investor_relations

SSA Yearbook 2021

The annual guide to the world's most significant supranational, sovereign and agency sector issuers.