Rentenbank

| SECTOR | Agency |

| RATINGS | AAA/Aaa/AAA |

| RATING OUTLOOK | All stable |

| FUNDING VOLUME 2020/21 | €11.4BN/€11BN |

| RISK WEIGHT, LCR LEVEL, SOLVENCY II | 0%, Level 1 asset in the entire EU, 0% |

| REPO ELIGIBILITY |

Yes, with a number of central banks worldwide |

About Rentenbank

Rentenbank is Germany’s development agency for agribusiness and rural areas. It was established by statute in 1949 as a central refinancing institution for the agricultural and food industry. Rentenbank pursues an integral promotional approach at low interest rates. It comprises the sectoral promotion of agriculture across the value chain, development of rural areas, and investment in renewable energies.

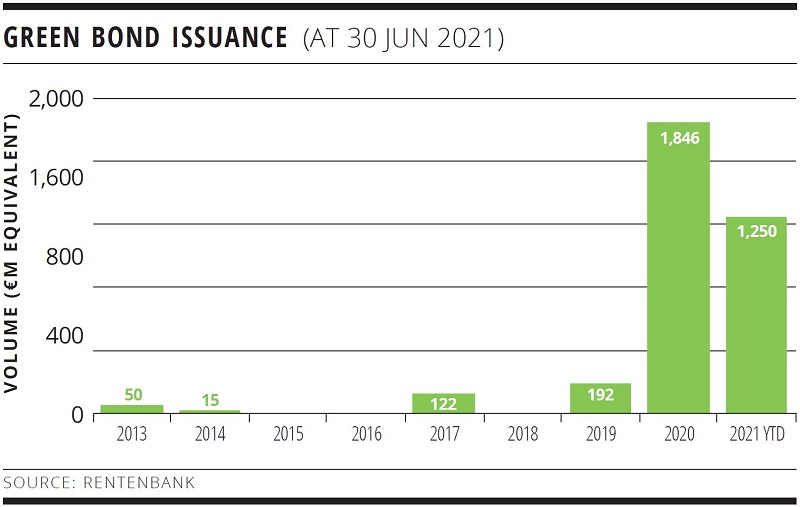

Sustainable funding strategy

In 2020 Rentenbank published its Green Bond Framework, which is in line with the Green Bond Principles and stipulates that proceeds from green bonds are used to fund renewable energy projects to mitigate climate change, EU Environmental Objective 1. Furthermore, Rentenbank’s green bonds contribute to UN Sustainable Development Goals ‘Affordable and Clean Energy’ (goal 7) and ‘Climate Action’ (goal 13).

In addition to its framework, Rentenbank publishes a Green Bond Investor Report on an annual basis, which consists of a Green Bond Allocation Report and an Impact Analysis. The Green Bond second-party opinion is provided by CICERO.

A dedicated Green Bond Committee has been put in place for evaluation, selection and monitoring of eligible green loans and further development of the framework. The issuance of green bonds under the framework is supplementary to green bonds issued before 2020.

SUSTAINABILITY OBJECTIVE OF GSS BOND PROGRAMME

Renewable energy.

| GSS BOND PROGRAMME NAME | Rentenbank Green Bonds |

| REFERENCE TAXONOMIES FOR THE USE OF PROCEEDS |

Member of the Green Bond Principles and Social Bond Principles, alignment of the Green Bond Framework with the EU Taxonomy on a best-effort basis. |

| FRAMEWORK WITH WHICH THE GSS BOND PROGRAMMES ARE ALIGNED | Green Bond Principles, Social Bond Principles |

| EXTERNAL REVIEW PROVIDER | CICERO Shades of Green (SPO) |

PUBLIC ISSUER ESG RATINGS/SCORES

| INSTITUTION | RATING/SCORE (all unsolicited) |

|

ISS ESG |

D+ |

FOR FURTHER INFORMATION PLEASE CONTACT:

Stefan Goebel, Treasurer

+49 69 2107 269

This email address is being protected from spambots. You need JavaScript enabled to view it.

Leopold Olma, Head of Funding, Treasury

+49 69 2107 225

This email address is being protected from spambots. You need JavaScript enabled to view it.

www.rentenbank.de

SSA Yearbook 2021

The annual guide to the world's most significant supranational, sovereign and agency sector issuers.