Avanti Finance

About Avanti Finance

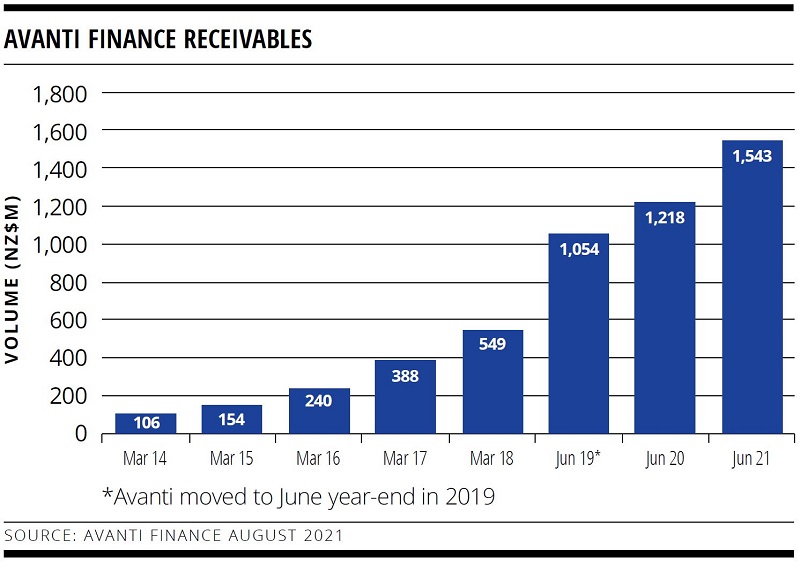

Avanti Finance has been active in New Zealand for more than 30 years, assisting more than 100,000 people by providing a range of consumer and business-loan solutions. The company has a history of strong growth in mortgage and motor-vehicle lending, with these sectors the pillars of future growth for the business.

Avanti also provides personal loans, SME lending and insurance-premium funding in New Zealand through its Avanti, GetCapital, and Bexhill brands.

Avanti has also operated a prime motor-vehicle financing business in Australia since 2019 through its BFS brand.

New lending is sourced predominantly through a network of introducers – primarily brokers, advisers and motor-vehicle dealers. Avanti has established strong relationships through these channels, many of which have worked with Avanti for many years.

Avanti’s target market is middle New Zealand and Australia and includes borrowers whose financing needs are not always catered for by the tighter credit criteria of the major banks or other mainstream financial institutions. This builds into Avanti’s mantra, to be the “first nonbank choice” for borrowers across a range of lending products.

Avanti recently won the Most Preferred Non-Bank Lender award from Mortgage Express in New Zealand, for the fourth year running. The company embraces corporate social responsibility and community involvement, through either sustainable resource-management initiatives or support for projects that are beneficial to the community, region or country as a whole.

| SIZE OF LOAN BOOK | NZ$1.5BN |

| MAKEUP OF LOAN BOOK | RESIDENTIAL MORTGAGES: 58% MOTOR VEHICLE LENDING: 32% CONSUMER LOANS: 6% BUSINESS LENDING: 4% |

| GEOGRAPHIC DISTRIBUTION OF LOAN BOOK | NEW ZEALAND: 90% AUSTRALIA: 10% |

| OUTSTANDING DEBT ISSUANCE | SECURITISATION: NZ$325M SECURITISED WAREHOUSES: NZ$850M CORPORATE FACILITIES: NZ$190M |

Funding strategy

Avanti’s funding is provided by a considered mix of shareholder equity, secured medium-term notes, and structured bank and third-party funding. It raised additional capital to support growth in 2016, 2019, and 2020.

Avanti has been a regular issuer of prime and nonconforming RMBS since 2018 and will further enhance its investor offering by establishing a motor-vehicle ABS programme in the future, as part of its growth strategy.

FOR FURTHER INFORMATION PLEASE CONTACT:

Paul Jamieson

Group Treasurer

+64 22 651 2052

This email address is being protected from spambots. You need JavaScript enabled to view it.

Mark Mountcastle

Chief Executive

+64 29 770 0007

This email address is being protected from spambots. You need JavaScript enabled to view it.

www.avantifinance.co.nz

nonbank Yearbook 2021

KangaNews's sixth annual guide to the business and funding trends in Australia's nonbank financial-institution sector.